- #MORTGAGE CALCULATOR WITH AMORTIZATION TABLE HOW TO#

- #MORTGAGE CALCULATOR WITH AMORTIZATION TABLE SERIES#

- #MORTGAGE CALCULATOR WITH AMORTIZATION TABLE DOWNLOAD#

You can use some similar formulae that work similarly to the PMT formula. You can learn more about Google Sheets Compound Interest in our article.

#MORTGAGE CALCULATOR WITH AMORTIZATION TABLE SERIES#

PMT is also unsuitable for use when you wish to calculate the current value in a series for recurring future payments, as this calculation also considers compound interest. The PMT formula does not account for compounding interest which can cause your calculations to be incorrect. It can be either 1 or 0, with 1 specifying the start of the period while 0 specifying the ending. end-or-start: This is an optional parameter that is used to specify whether the payments are due at the start or the end of each period.future-val: this is an optional parameter that defines the value remaining in the future after the final payment is made.present-val: this is the current annuity value.period-number: this parameter defines the number of payments that need to be made.rate: this parameter defines the interest rate.

Now that we know the formula’s syntax let’s look at the parameters. Let’s take a look at the formula: =PMT(rate, period-number, present-val, future-val, end-or-start) We will use the PMT formula to make a Google Sheets loan payment template. The formula considers key factors like time, interest rate, and loan amount. This Google Sheets mortgage formula can be used to budget for loans or compare various loan options. The PMT is a Google Sheets amortization formula that allows you to calculate the loan’s monthly payments. Related: Loan Amortization Schedule Google Sheets Template + Guide What Is PMT Google Sheets? The formula to calculate amortized loans is a bit complex. As the interest part of the payment decreases, the original loan amount is increased. In amortized loans, the interest expense for the period is paid off first, after which the remaining payments are made to reduce the total sum. In an amortized loan, scheduled payments are applied to the loan’s original sum and the interest accrued. As we mentioned, some ARM terms have fixed interest for the first few years before the lean term changes to a changeable interest rate for the remaining term.Īlthough it can save you substantial money, the monthly payments can become unaffordable, resulting in a loan default if the interest rates were to skyrocket. The interest rates can fluctuate in adjustable-rate mortgages due to varying market conditions. Interest rates generally are higher than the rates on mortgages with adjustable rates. However, if the interest rate falls, you will have to refinance to get lower rates. But, in the US, fixed-rate home loans can be for the loan’s entire life (30 years). Then the loan will switch to an adjustable rate. In most countries, fixed loans generally come in 1-5 year fixed terms, although some allow you to pick a period of up to 10 years. In a fixed-rate mortgage loan, the interest rate is kept the same for the loan’s lifetime, which means that the monthly mortgage payments will never change. Here is the formula you’d use: =(interest-rate * loan-amount) / 12 Fixed-Rate Mortgage Then divide the amount by 12 to determine how much you need to pay monthly. You can calculate monthly payments for an interest-only loan by multiplying the total loan amount by the interest rate. However, this stops you from building equity, and there will be a massive jump in the payments whenever the interest time ends. In interest-only payments, you will be making smaller payments for a while.

The payments can be either the entire sum at a specified date or subsequent payments at fixed intervals. Interest-Only LoansĪn interest-only mortgage requires the borrower to pay the interest on the loan for a fixed amount of time. Here are some types of loans, and how you can calculate the payments. However, there are a lot of different types of loans to consider, and they interact with a mortgage calculator differently. The process for calculating loan payments is straightforward.

#MORTGAGE CALCULATOR WITH AMORTIZATION TABLE HOW TO#

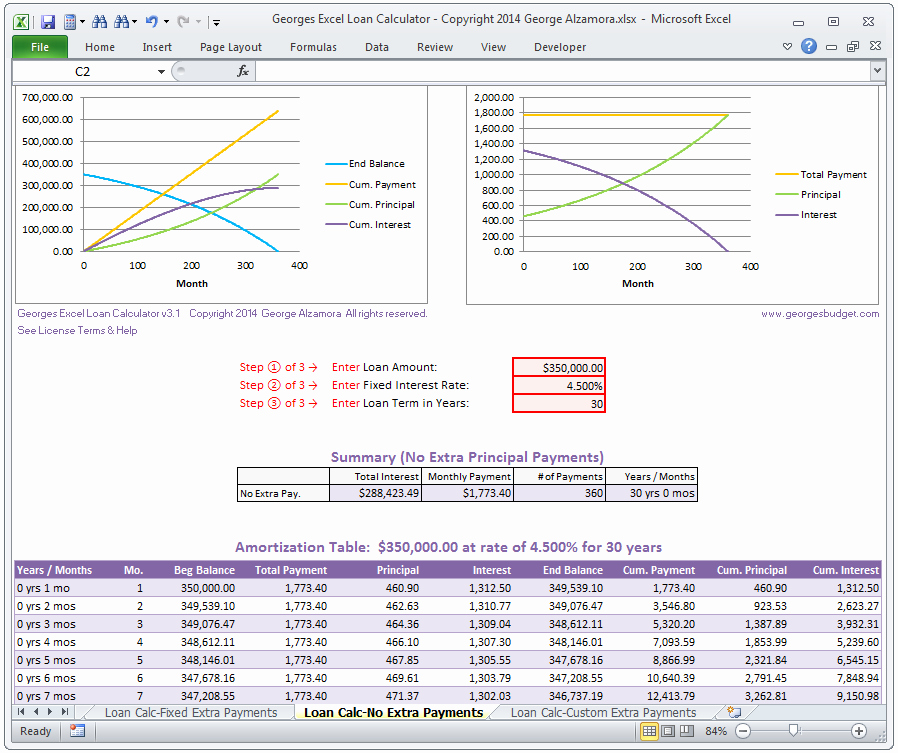

How to Build a Mortgage Calculator Google Sheets Templateĭownload a Google Sheets Mortgage Calculator Template Types of Loan Payments.

#MORTGAGE CALCULATOR WITH AMORTIZATION TABLE DOWNLOAD#

Download a Google Sheets Mortgage Calculator Template.

0 kommentar(er)

0 kommentar(er)